My first full-time job at a CPA firm with three classes left to earn my dual master’s degree. Goal realized, I thought. Seven weeks in, the Feds raided.

FBI raids Bureau of Reclamation regional headquarters

Las Vegas developer indicted on charges of tax fraud

I began working at LL Bradford CPAs in December of 2015. At the time, the company was rated as one the top accounting firms in Clark County Nevada. We had daily company meetings, I felt welcomed and supported. I worked in a separate newly formed accounting department that prepared tax returns for clients referred by another company.

" We offer real estate investment coaching programs and live training events for investors. ... is the premier real estate education company in the country. Founded by nationally recognized real estate investors, we have developed the systems, tools, educational platform and coaching program to accelerate new and existing real estate investor businesses."

This company holds seminars in various cities across the U.S. The cost of the seminars ranges from $35,000 to $50,000. The investors were then referred to another company that handled the business formation paperwork for all 50 states. This company charged around $11,000 and would set up two to three entities per client. This was done under the guise of asset protection.

"... has been the business startup specialist in Nevada for 30+ years. We’ve formed hundreds of thousands of business entities worldwide and have a nationwide reputation for assisting entrepreneurs. ... is the leading provider for the formation of Nevada Corporations and Nevada LLCs, asset protection strategies and many other business and financial services. Unlike other incorporating companies, ... offers a wide range of services to help your business succeed."

The department I worked in had nonstop turnover. The job was super stressful and people would break. We all cried eventually. We worked overtime (8am -6:30pm were regular hours) and were not compensated. We were paid embarrassingly low wages for our industry well some of us were. Everyone who left was treated as a traitor.

Clients would call screaming believing we were all one company. They had been sold a dream, but reality came crashing down. One of my coworkers with whom I shared an office, Pete, started smoking cigarettes, eventually got shingles had a stroke and died. He was really good with the clients on the phone, I guess he internalized their screams. The sales manager's stance was "I'll never hire anyone over 50 again." Another story conveyed to me by other coworkers, "we do not think he (a former employee) was using heroin until he started working here." Two others had heart attacks at their desks, another just started screaming at everyone.

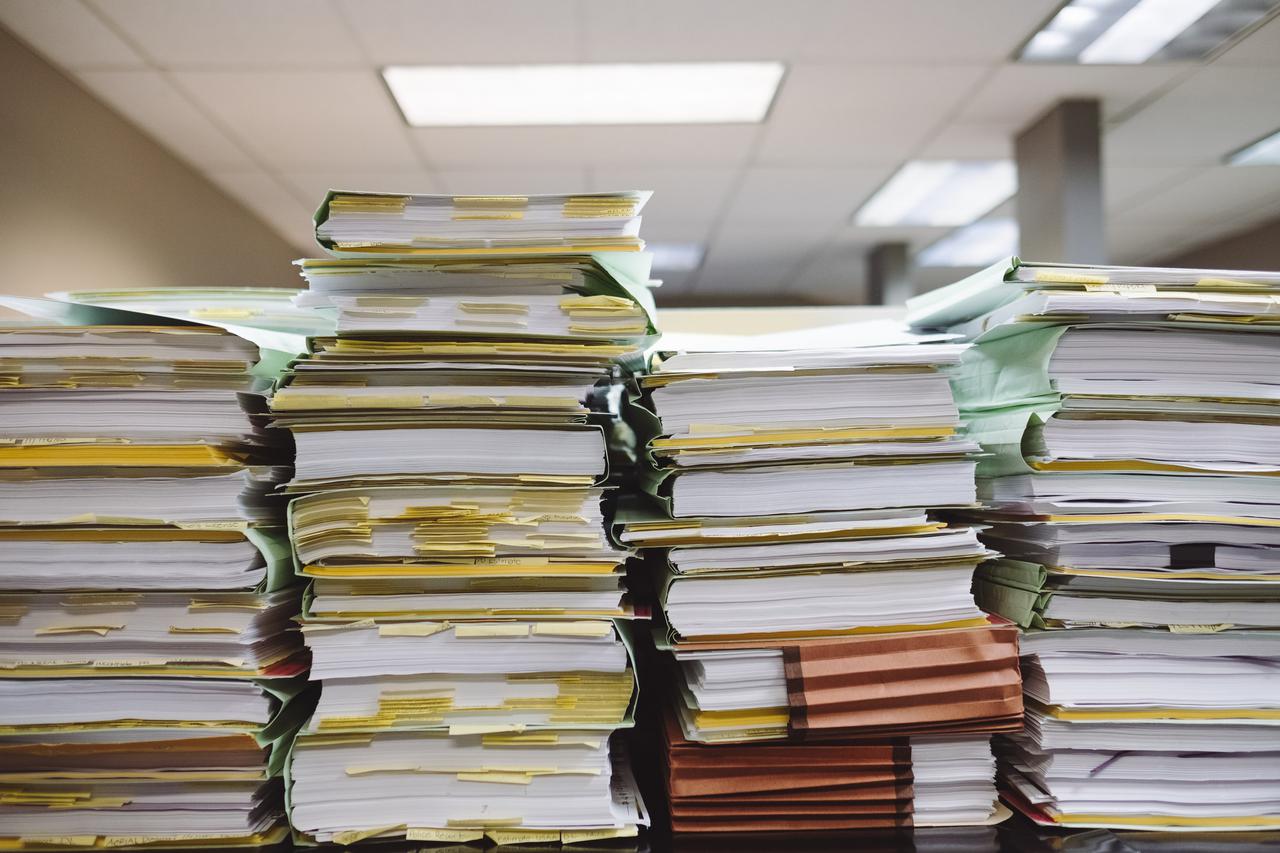

Since the seminars were conducted year-round and nonstop, we continuously received new clients. I would have 200 red files on my desk at a time. We had to be creative in storing files since we had so many, and they took up so much space. Every day the two administrative assistants would deliver new client files. They sometimes had to be creative because some of my coworkers would be visibly and audibly frustrated. For some, the admins would wait until they went to the bathroom or left their office before placing new client files on their desk.

The company that formed and registered the entities for clients would form two or more entities per client under the guise of audit protection. For example, a client may attend a seminar with their spouse or relative. The company would set up a partnership that flowed into two S-corporations that flowed into a Solo 401-K.

The screaming would begin when we prepared a client's tax return. Unbeknownst to us, the accountants, the clients were told their initial investment would be returned to them once they filed their tax return. The clients were told to draft a promissory note (red flag) stating their business owed them the return of their initial investment. For instance, a client paid $50,000 to attend the real estate investment program and expected a $50,000 refund on their tax return.

I would repeatedly have this conversation with clients, "your business has to make money before you receive compensation. Most businesses do not make a profit in the first few years. First, you have to buy a property, renovate the property, and sell it for a profit. If you sell it for a loss, there is no money to pay the promissory note. Also, you have an S-corporation or partnership so the profit or loss flows to your personal return." Explaining that the $50,000 was a start-up cost or organizational cost and would be expensed (amortized) over 180 months was the worst part of the conversation. There would be that uh-huh moment when the client realized they were misled.

Another point of contention was the state fees associated with their businesses. For instance, California charges an $800 annual Franchise Tax per business. I would have to inform clients they owed $2400 plus late fees. The clients usually owed late fees since they were not informed of the state charges until we prepared their tax returns a year later.

Once I had to inform a client that he could not file his S-corporation return because legally he was not allowed to be a shareholder since he was a Canadian citizen.

Four weeks in, I was called to the head manager's office eight days in a row. My coworkers wondered what trouble I was in to be called into the head of our department's office with other managers involved. The door would close. My offense? I discovered that the S-corporation paperwork had not been filed for New York or New Jersey. These two states are unique because unlike other states that accept the federal S-corporation tax designation New York and New Jersey require separate filings. If these filings are missed, the client cannot file their business return and subsequently cannot file their personal return because S-corporations are flow-through entities meaning their profit or loss is reported on the personal tax return (1040).

The clients would be extremely angry, they wanted to know who was responsible. " I paid over $60,000 how is this possible?!" they would scream.

Once the paperwork is missed it would take up to three to five months to rectify the situation. I would try to soothe the clients by stating, "I called the state they have no record of the S-corporation filing but I filled out a new application and emailed it to you. You just need to sign it and I will fax it to the state. I will keep calling the state until acknowledgment."

Not only were New York and New Jersey's S-corporation paperwork late, the business formation company would also miss the federal deadline to file the S-corporation paperwork so the client would receive a notice from the IRS that they were either assessed a penalty or their business return could not be processed. We would assure them that this would be handled and wrote Abatement letters to the IRS for the clients asking the penalty be waived. We did this so often I thought this was a regular CPA service.

The company that formed the entities labeled me the angry black woman. My managers combed through my emails to clients saying I was not supposed to lay blame, something I never did. My managers said my emails were rude and not result-focused. I constantly asked them to show me an example, they never did. Later, I found out from one of the partners of LLB that my managers would forward my emails to him. He said, "I've heard you have a bad attitude but now that I work with you I don't see it. They forward your emails to me but I can't find one that's a problem."

One day I was in my office, I answered the phone to a woman who was screaming. She was screaming so loud my coworkers in other offices could hear her and I was not using the speaker. The client was upset because she had received a golden parachute payment of $350,000 from her company as compensation because her job was discontinued. She blamed me for the taxes she owed to the IRS. "You should have known and done something," she screamed.

Another instance, a client from Massachusetts, I cannot remember the city I am from Boston so I felt a kinship, remorsefully stated, "I should have never given these people $35,000. Now my truck payment is due. I will probably lose my house. I'm gonna just kill myself!" He repeated the last sentence over and over.

The company that held the real estate seminars would convince people to relinquish the accountants they had been working with for years and use LLBradford's accountants. The clients' previous accountants were familiar with the clients' personal, professional, and financial history. We had so many clients (2,000) and so few preparers (5 maybe) and one reviewer, we never had the time to familiarize ourselves with any particular client.

Eventually, these clients would come to the realization that they would never recoup their money. Some clients were retired, elderly couples who did not have the energy to find a property, renovate, and sell it. Many realized their state real estate market was not viable or by the time they paid contractors to renovate a property, there was no profit to be made. There was no profit in flipping a house in NYC, Florida or CA, or New Jersey. Many realized they would have to travel to other states to look for a property which simply was not an option.

Seven weeks in, my department was located on the first floor of a three-story building (pictured, building on left). All other offices (the main accounting department, receptionist, partners' office, audit department) were located on the third floor. Most of the offices in my department faced the parking lot. We saw a police car parked. We joked with each other, "oh they're coming to get you." We guessed the police officer was probably a client. This was about 10am. Next, we observed someone walking by with a jacket that said Attorney General and then another with IRS. The phones and internet stopped working. We went to the managers for guidance, nothing. No one was brave enough to go to the third floor. We waited.

An hour later everyone from the third floor came rushing down the stairs. " Oh my God! 70 federal agents came rushing in from the side emergency exit doors with their guns drawn! They told us not to move, kicked in the server door and took the server! Some came up through the elevator and then separated us in groups. We had to show our ID's and they wrote down our names!" Chaos!

As this was going on, the head of my department never left his desk, never looked up. He was texting someone, never gave us guidance. This happened on a Thursday. We mulled in the lobby of the first floor for about 15 minutes. Many decided to go home it was around 11am. We never heard from a manager or partner we did not know if the business was closed. We did not know if we should show up to work the next day. We kept texting each other, watching the news, and Googling that is when we found out that one of the partners (the main focus of the investigation and raid) had lost his CPA license before. We found out a few partners had been fined for unethical practices.

We showed up for work the next day expecting a note on the door that the business was shut down. No note, no meeting, all the managers and partners acted like business as usual. We had a meeting that Monday and we were told not to believe what we were hearing on the news.

I worked at LLB for a year and a half. After, the raid by the FBI, Attorney General, IRS, and others the company split into three separate companies. The partner that was the focus of the raid took over the leadership of our department which was now a separate company. I was no longer allowed to prepare taxes for any new clients I was barred by the formation company (I never met or spoke with anyone in this company until a year later).

99% of the clients dissolved their businesses within two years. If only they had taken the time to consult with an accountant before investing. I charge $100 for an hour to an hour and a half for business consultations. I would have researched the real estate market or whatever industry they were interested in and let them know if it was viable. I would prepare the paperwork to form a business and charge between $250 - $1000. I would listen to their expectations and goals and let them know the steps to achieve their goals if possible. I would have informed them about their tax obligations, rules, and regulations in their state. I would guide them to blogs about passive income, real estate, gig economy - free information. These people spent upwards of $60,000 to learn a hard lesson.

A year in I found the lump in my breast, four months later a friend referred me to a company where a large percentage of ex-LLB employees worked. I left April 10th, a week before the deadline.

*Note - Beware of flashy conventions, charismatic, ostentatious leaders, and hard to explain investment strategies. Before you invest, speak with someone with no ties. Explain the investment strategy out loud. If you cannot clearly explain how you are going to profit off this investment it is definitely time to rethink. Never, I mean NEVER put all of your money in one investment. Red flags -promissory notes, "we are family, returns higher than the market, this is not a pyramid scheme", fast talkers. Also, watch American Greed - a lot and documentaries like the Panama Papers (Netflix's The Laundromat), Enron, WeWork.

For business formation filings, compliance services, sales and payroll registrations, business licenses and permits, and trademark search and filings I partner with CorpNet. Attached is a price list (2020) for the services offered.

https://acrobat.adobe.com/link/track?uri=urn:aaid:scds:US:e44e9be7-b80f-32de-874d-29fa4d900629